How to Start Trading? – 0 to Pro

How to Start Trading: A Step-by-Step Beginner’s Guide

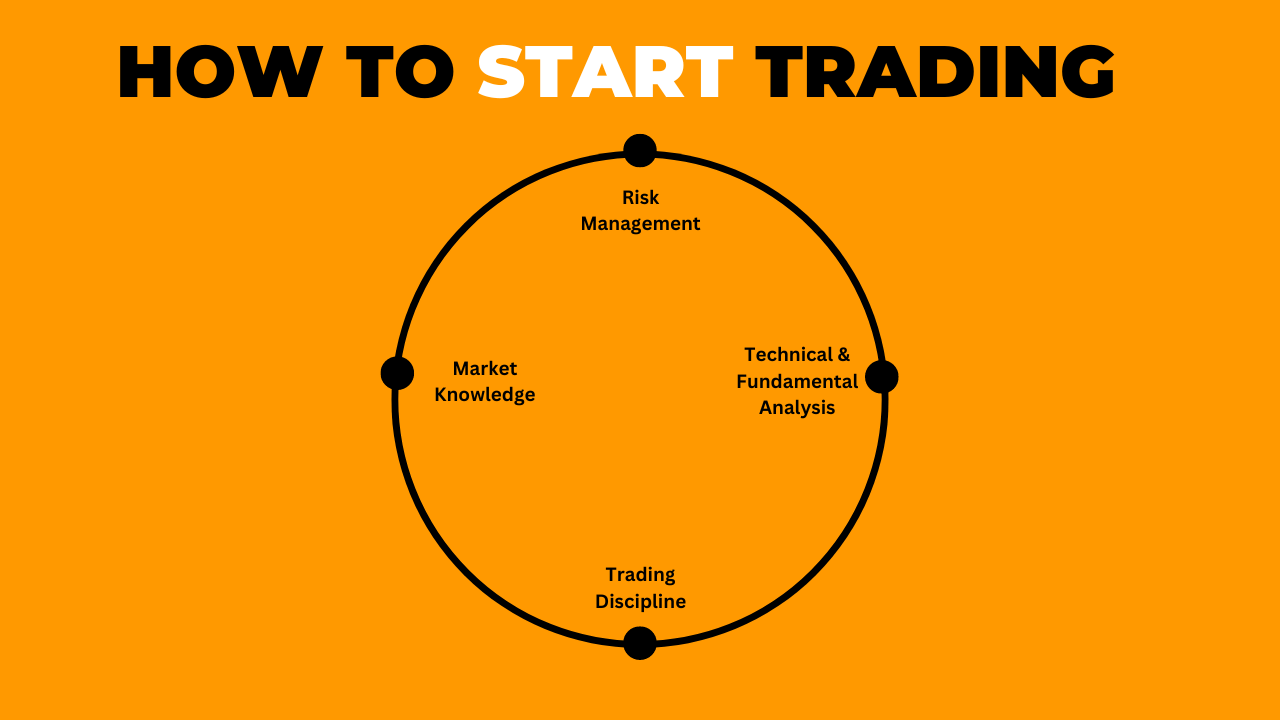

Trading has become a popular way to grow wealth, thanks to accessible online platforms and diverse markets like stocks, forex, and crypto. However, success requires knowledge, strategy, and discipline. This guide breaks down how to start trading, even if you’re a complete beginner.

Why Start Trading?

Trading offers opportunities to generate income, hedge against inflation, and diversify investments. Whether you’re interested in stocks, forex, or cryptocurrencies, the right approach can help you capitalize on market movements.

Step 1: Understand the Basics

Before diving in, learn key concepts:

- Types of Trading: Day trading (short-term), swing trading (medium-term), and long-term investing.

- Markets: Stocks (e.g., Apple, Tesla), forex (currency pairs like EUR/USD), and crypto (Bitcoin, Ethereum).

- Key Terms: Pips, leverage, volatility, and dividends.

- External Link: Master financial jargon with Investopedia’s Trading Glossary.

Step 2: Set Clear Goals & Assess Risk

- Define your objectives: Are you seeking quick profits or long-term growth?

- Determine your risk tolerance: Never invest more than you can afford to lose.

- Internal Link: Use Bullarti’s Risk Management Guide to protect your capital.

Step 3: Choose a Reliable Trading Platform

Select a platform that aligns with your goals:

- Stocks: TD Ameritrade (beginners) or Interactive Brokers (advanced).

- Crypto: Coinbase or Binance.

- Forex: MetaTrader 4 or eToro.

- Tip: Check fees, user reviews, and regulatory compliance.

Step 4: Educate Yourself

Knowledge is power in trading:

- Take free courses on Coursera or YouTube channels like Trading 212.

- Internal Link: Explore Bullarti’s Crypto Trading Strategies for niche insights.

Step 5: Practice with a Demo Account

Most platforms offer demo accounts with virtual money. Use this to:

- Test strategies without financial risk.

- Familiarize yourself with tools like candlestick charts and stop-loss orders.

Step 6: Develop a Trading Plan

A solid plan includes:

- Entry/exit rules (e.g., buy when RSI < 30).

- Daily profit targets and loss limits.

- Internal Link: Create a winning strategy with Bullarti’s Trading Plan Template.

Step 7: Start Small & Track Progress

- Begin with small amounts to minimize risk.

- Use journals like TraderSync to analyze wins/losses.

Step 8: Stay Updated & Adapt

Markets change rapidly. Follow:

- News sites like Bloomberg.

- Economic calendars for events like Fed rate decisions.

Common Mistakes to Avoid

- Overtrading: Stick to your plan.

- Ignoring Fees: High commissions eat profits.

- Emotional Decisions: Fear and greed lead to losses.

Final Thoughts

Trading isn’t a “get-rich-quick” scheme—it requires patience and continuous learning. Start small, stay disciplined, and leverage resources like Bullarti.com to refine your skills.

Ready to dive deeper? Check out our Beginner’s Guide to Technical Analysis.