1. What is Cryptocurrency?

Definition: Cryptocurrency is a currency that can be used only electronically and it encompasses things like Bitcoin. It is created to be a means of exchange where it relies on the use of encryption to protect transactions, regulate the generation of more coins, and authenticate asset exchange. Unlike other forms of money that is physical like the US dollar and the euro, the crypt currencies are generally digital and function on block technologies.

Key Characteristics:

Decentralized: Currently, cryptocurrencies work in decentralized systems that include no authority such as the government or bank. They used them based on a correspondent record of all transactions occurring on a distributed ledger (Blockchain).

Cryptographic Security: It makes the transactions to be secure, private and verifiable hence enhancing its security. Every transaction is signed by means of private key and this makes every transaction secure.

Transparency Records: All the transactions that are conducted are recorded on the ledgers which are known as the block chain and these are available for public viewing. While transaction information is quite open, the names and other essential info of the users are often unknown.

Immutability: In its simplest form, once a transaction is entered into the blockchain it cannot be changed or deleted, thus making the records safe.

Global Accessibility: The use of the crypto currency is the same as that of the internet, and hence does not require geographical boundaries and hence is borderless as opposed to the banking systems.

Popular Cryptocurrencies:

Bitcoin (BTC): The first and arguably the most famous one, it is commonly called the ‘digital gold. ’

Ethereum (ETH): An application that is digital currency as well as an operating system to support the decentralized applications and smart contract.

Ripple (XRP): A cryptocurrency that caters to the need of making cross border prompt payments at a minimal cost.

Litecoin (LTC): A decentralized digital currency that operates as an alternative to Bitcoin and which confirms transactions in less time as compared to Bitcoin.

2. What is Cryptocurrency Mining?

Definition: Mining is the generation of new crypt currency coins or tokens it also refers to the verification of new transactions and addition of these to the blockchain. In PoW based systems such as bitcoin mining is the process that involves solving of complicated mathematical problems with the help of computational power. This work is done by miners to maintain the network and they are compensated by the bitcoin or any other digital currency.

How Mining Works:

Blockchain Validation: Crypto coins run on a decentralised system where many nodes which are computers have to approve a transaction. In this process, computational resources are employed to solve some cryptographic puzzles that check the authenticity of such transactions.

Proof of Work (PoW): As in the case of Bitcoin, PoW systems involves miners trying to solve various complex mathematical problems. This task falls with the first miner who correctly solves the puzzle and can append a new block of transaction in the blockchain, with the incentive of the newly generated digital currency.

Mining Rewards: Payment that is accorded to the miners is in two forms,

Block Reward: A newly developed cryptocurrency is awarded to the miner that manages to contribute a block within the blockchain.

Transaction Fees: The transaction fees of the transactions performed in the new block also belong to the miners.

Energy Intensive: Mining is very much computer intensive as miners use hardware devices such as ASICs and consume a lot of electricity to solve these riddles.

Mining Algorithms:

Proof of Work (PoW): The most widely used bitcoin mining algorithm where the miners have to complete some specific tasks to secure the transaction.

Proof of Stake (PoS): Another consensus where validators are selected according to the number of coins they own and are ready to ‘lock’ in the smart contract called ‘stake’.

Hybrid Systems: Some of the newest crypto solutions incorporate both the PoW and PoS to make a more effective and secure network.

3. How Does Cryptocurrency Work?

Blockchain Technology:

A blockchain is a decentralized ledger that holds all the records and transactions of the cryptocurrencies and these records are stored in a distributed manner in a network of computers known as nodes. Every block in the blockchain is a record of recent transactions, and, when the block is inserted in the chain of blocks, it is resistant to changes.

Blockchain acts as a guarantor of openness, protection, and distribution to exclude the possibility of someone’s monopoly over the network.

Transaction Process:

Initiating a Transaction: When a user for instance wishes to send cryptocurrency to another user creates a transaction request. The components of this transaction are details of the amount of crypto coins being transferred from the payer, the identity of the payer wallet and that of the payee and the digital signature of the transaction.

Broadcast to the Network: The information of such a transaction will be relayed to the cryptocurrency network and then received by the miners or validators.

Verification by Miners: Due to this miners work to ensure that the transaction is valid by solving some complex mathematical problems which see to it that the sender has enough money to fund the transaction. This process helps eliminate the risk of one using the same crypto asset to transact severally.

Adding the Transaction to the Blockchain: After the transaction made is checked it is then placed in a new block. The received block is next placed in a sequential order on the blockchain increasing the security of the past and the content of future blocks.

Confirmation: Once the transaction is done and included in the blockchain ledger it becomes permanent and cannot be altered. At the same time, the use of additional confirmations also strengthens the transaction in question.

Wallets and Keys:

Wallets: Cryptocurrency wallet is an application which enables one to receive, store and transfer cryptocurrencies. There are mainly two kinds of wallets: software wallet, where your Bitcoin can be accessed from the internet or from the computer and hardware wallet, which is a physical device like a flash disk.

Public and Private Keys:

Public Key: This is the one a user provide to receive the cryptocurrency like a user account or an ID number.

Private Key: This is a unique numerical password for signing of transactions and gaining access to one’s cryptocurrency. This must be made secure since anyone controlling the private key in regard to this fund will have power over the resources.

Security Features:

Cryptographic Hashing: Every block and the transaction is hashed or converted to a fixed length string and the same is done with the help of cryptographic algorithms so as to avoid data tampering.

Consensus Mechanisms: One of the primary purposes of the cryptocurrency networks is that they are based on the consensus mechanisms such as PoW or PoS in order to decide the validity of the transactions without a central authority.

Pseudonymity: Whereas the system itself is open for the public, the users’ true identities are actually concealed, although their transactions are transparent.

4. Applications and Use Cases of Cryptocurrency:

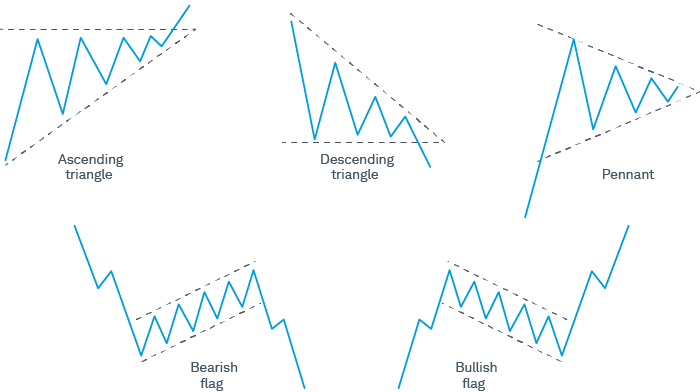

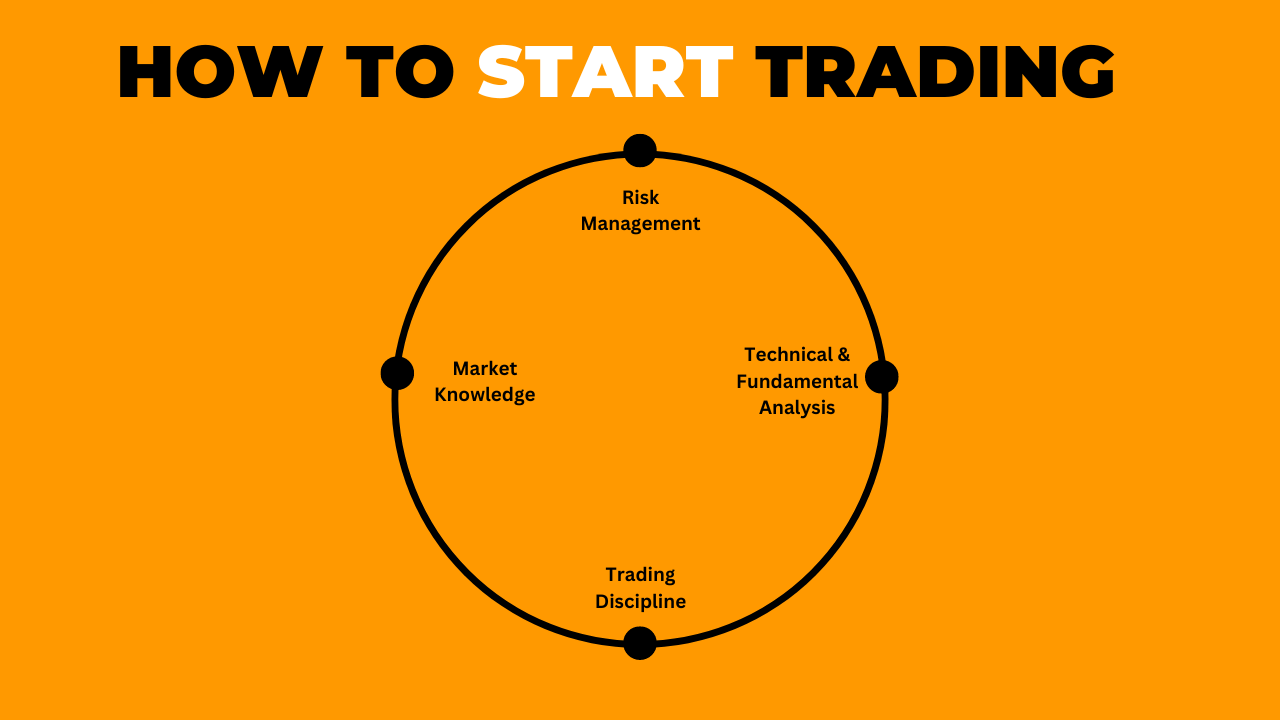

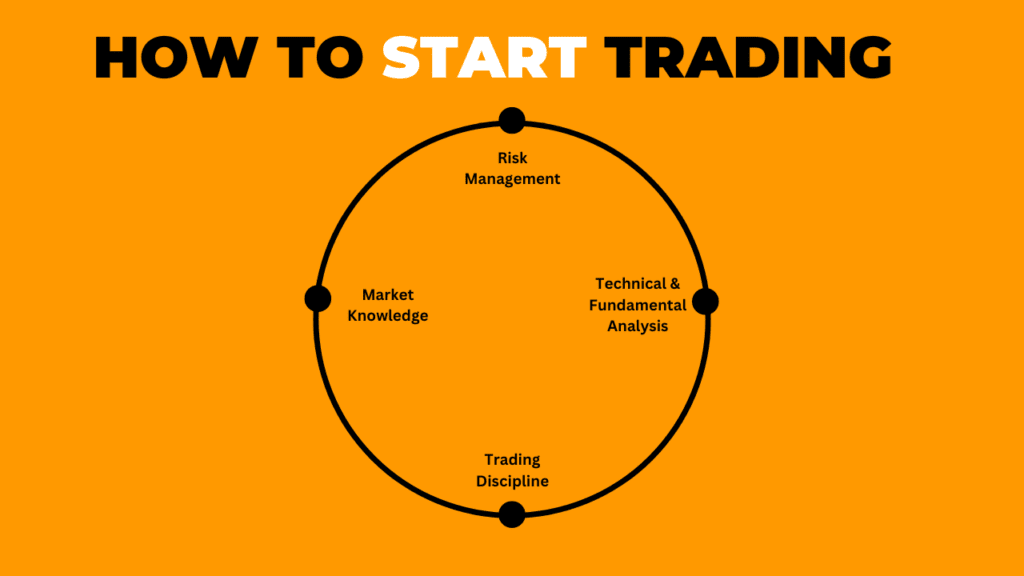

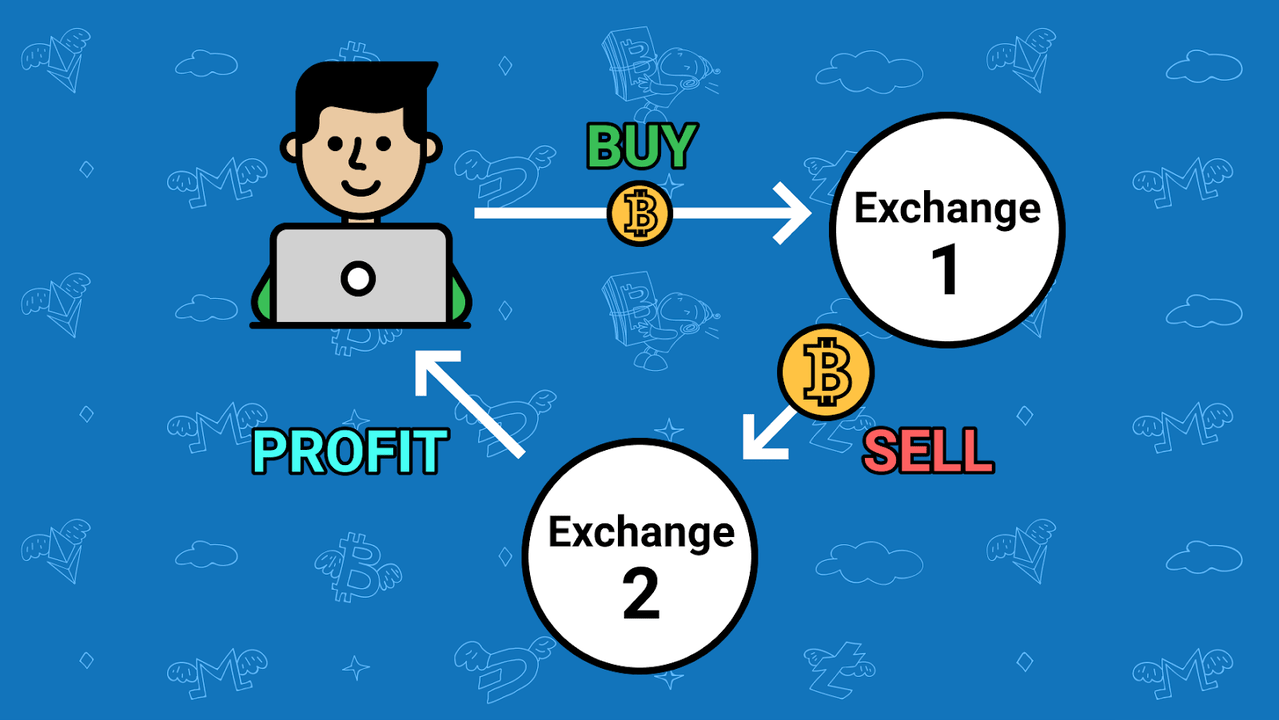

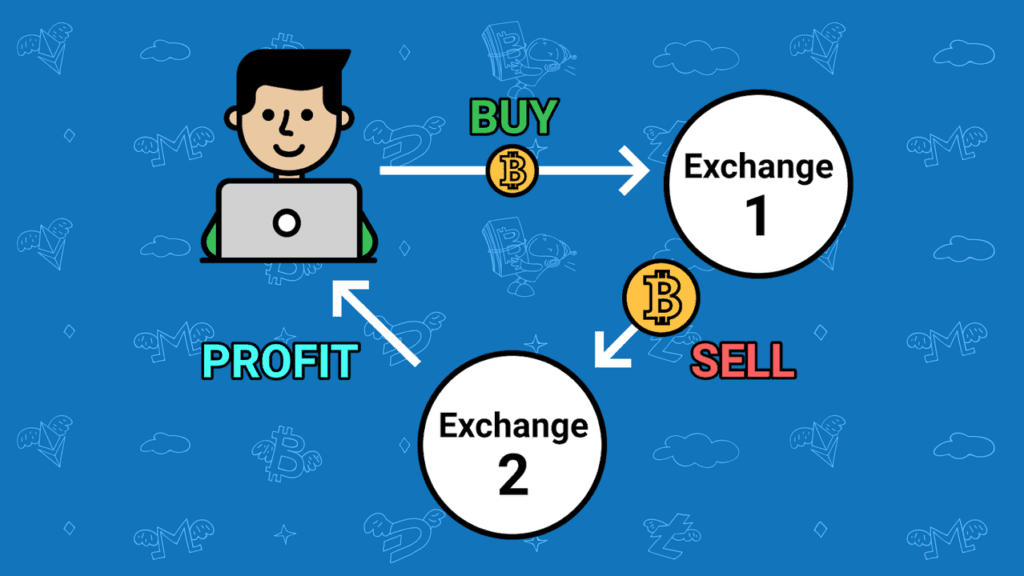

Investment and Trading: Cryptocurrencies are employed as an investment type, whereby individuals buy and sell them with an intention of making a profit through high risk ventures.

Payments: Cryptocurrencies are also used by some establishments as a method of payment, as a replacement for the fiat money.

Decentralized Finance (DeFi): DeFi platforms utilize cryptocurrencies to offer such value-added services such as loans, savings, and trading without the involvement of centralized institutions such as banks.

Smart Contracts: Cryptocurrencies such as Ethereum allow smart contracts; which are digital contracts that are programmed to execute automatically.

Cross-Border Payments: Here, one can assert that Cryptocurrencies work much faster and cost less than the traditional banking systems in terms of international money transfers.