What is Bitcoin Mining?

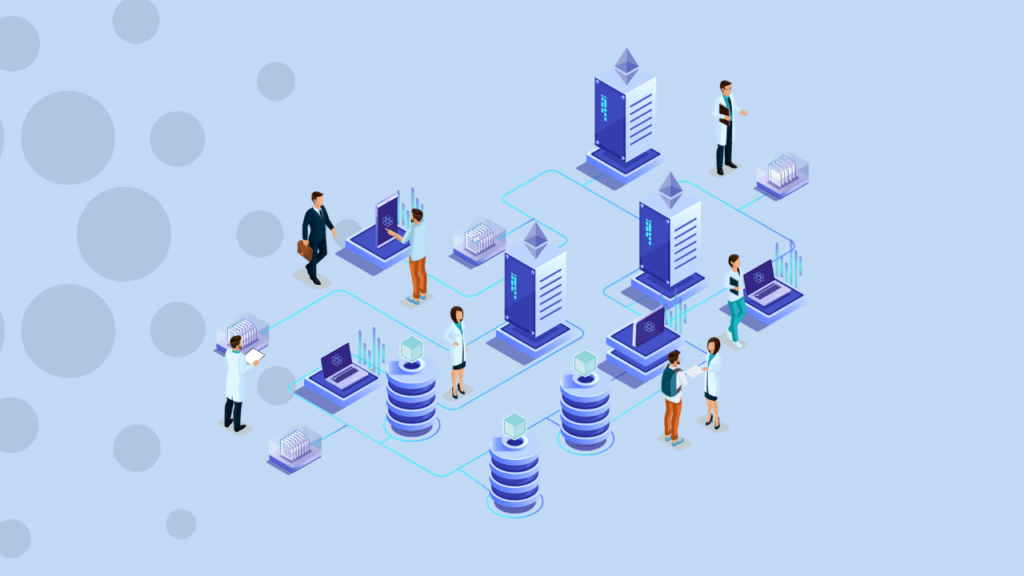

Bitcoin mining is the digital process through which bitcoins are created and users’ transactions validated on a blockchain. It entails the use of complex algorithms in the form of mathematical problems to be solved in order to gain new blocks in the chain that would help in the security of the Bitcoin market. These puzzles are solved by the miners, and whoever solves it first gets the chance to add a new block on the chain and in return he receives newly created bitcoins as well as other transaction fees.

What is Bitcoin Mining Process?

The cryptocurrency which is involved in the process of Bitcoin mining can be described as a Peer-to-Peer Digital Money which uses a Proof of Work (PoW) Consensus Services to validate all the transactions in the network. Here’s a breakdown of how it works: Here’s a breakdown of how it works:

Transaction Broadcasting:

Bitcoin was designed such that transactions are created by users and sent to all the nodes in the network. Such transactions are gathered into a “pool” called the meme pool where they anticipate to be processed.

Miners Compete:

Miners select unverified transactions from the memory pool and arrange the transactions into block. To include this block in the blockchain there is a need to search for a value for the cryptographic hash function that satisfies the requirement of mining which is time consuming.

Proof of Work:

The cryptographic puzzle means that one has to find that special number called nonce, which when hashed with data in the block, will give the hash below the target figure set by the network. This process must be random-strategies and, therefore, many tests are made and results are experimental.

Block Addition:

For instance, if a miner solved the puzzle and found the right hash, he/she will relay the block to the entire network. Other miners and nodes check on the validity of the block and once cleared the block is added to the blockchain. Upon the inclusion of the block, the miner that packaged it wins new bitcoins and the fees collected from each of the transactions.

Block Reward:

The block reward is the pay which the miners earn in order to continue providing security in the networks. First, this reward was 50 BTC per block, but they reduce in time in an occurrence known as ‘halving. ’ At the time of this writing, the incentive is only 6. Currently 25 bitcoins per block which has been like this since the most recent halving in 2020 and this is cut in half roughly every four years.

The following are the types of equipment used in the mining of Bitcoins;

Bitcoin mining cannot be done by normal computers or graphic cards since it needs special hardware referred to as Application-Specific Integrated Circuits (ASICs). These devices are quite unique and are specifically crafted to mine Bitcoins and not any other cryptocurrency and are a lot more efficient and better than cpus and gpus.

ASIC Miners:

ASICs on the other hand are very robust and expensive machines designed for mining cryptocurrencies alone. They use high amounts of electricity while providing lots of hashing power making miners to have high chances to solve the cryptography challenge than others.

Mining Pools:

With the increase of mining complexity, miners start pooling their resources and come together in what is known as mining pools. In a pool, the reward is then divided among the participant based on relative share in the computation power used. This makes it possible for smaller miners to be able to make consistent earnings.

Bitcoin Mining Difficulty

Bitcoin controls the miners’ density and alters the overall hardness of the bitcoins network if the computing power employed exceeds what is required for a blockage to be generated every ten minutes. This difficulty adjustment is done after every 2,016 blocks which is nearly after two weeks. The general idea is that, when more people join the network and more miners join, mining becomes more complex because the hash needs to be correct. On the other hand the opposite is true where miners leave, the difficulty reduces.

Energy or power utilized in mining of bitcoins

The mining of bitcoins is quite energized and is considered to be a very energy-consuming process. The PoW Algorithm also calls for the use of a very huge amount of electricity as the miner has to calculate to the tune of billions to arrive at the block solution. This has raised questions on the environmental effect of Bitcoin especially the power employed in the mining procedure, most of which is from the renewable source.

However, there have been cases whereby some mining operations are using hydropower, solar and wind energy as ways of powering the Bitcoin mining machines while trying to reduce on the impact they have on the environment.

Mining by Definition:

An Introduction to the Economics of bitcoin Mining

Although Bitcoin mining is very lucrative most of the time, the venture requires a lot of capital. Here are some of the key economic factors to consider:

Here are some of the key economic factors to consider:

Hardware Costs:

Buying ASIC miners and other mining gadgets is not cheapy at times. With advancement in technology, the mining equipment also becomes archaic and therefore needs to be replaced to meet the market demands.

Electricity Costs:

Just as expected and mentioned earlier, one of the biggest cost factors when mining Bitcoins is power consumption. Mining requires cheap power sources this is why most mining facilities that are large-scale are often set up in areas that have cheap power rates.

Block Reward Halving:

The block reward of Bitcoin halves every four years, meaning that, the amount of bitcoins that the miners obtain per blocks is cut in half. This may affect the mining revenues and profitability since they do not get proportional to the rise in the prices of bitcoins.

Bitcoin Price Volatility:

As it has been pointed out they are dynamic in operation due to the fluctuating price of Bitcoin which determines their profitability. Sometimes with a small drop in price the cost of mining maybe pushed up to a level where it becomes unprofitable to mine for some or even many hence a reduction in the number of miners.

Is Bitcoin Mining Profitable?

It should however be noted that Bitcoin mining is profitable though depends with certain factors including the market price of a Bitcoin, cost of electricity, efficiency of the mining hardware and the level of difficulty involved. With increasing competition in the market, the profitability margins have reduced greatly meaning that small miners cannot make any decent profits without being part of a mining pool.

In Light of the above facts, the following can be said about the future of bitcoin mining:

This is because with the growth of every new advancement in the Bitcoin market, this mining sector will also change. Some future trends in Bitcoin mining include:

Some future trends in Bitcoin mining include:

Energy Efficiency Improvements:

Thus, there is increasing concern with Bitcoin energy consumption to use more efficient ASICs and to harness renewables to power the mining process.

Layer 2 Solutions:

Applications of solutions such as the Lightning Network, which works as a second layer in the Bitcoin network, could help decentralize the load distribution hence making the base layer to be efficient and not extremely demanding in terms of mining.

Decentralization of Mining:

There are voices expressing the belief that mining power becomes concentrated in some regions and certain actors. More steps are being made in an attempt to improve decentralization of Bitcoin mining to sustain the network’s security and stability.