What is Swing Trading and Their Strategies?

Swing Trading:

In simple terms we say that swing trading is a strategies or a trading style in which swing trader attempt to make a profit from the short term movement. Swing trader hold the financial asset such as stock , option or other commodities for several day, several week or month to capture the short term to medium term profit such as gain in stock or other commodities.

Day trading:

This technique or practice of selling and buying or investing in securities or stock within the same day. Day trader use this technique to generate profit in short time or enhance their trading skills in forex trading, stock, cryptocurrency or other commodities.

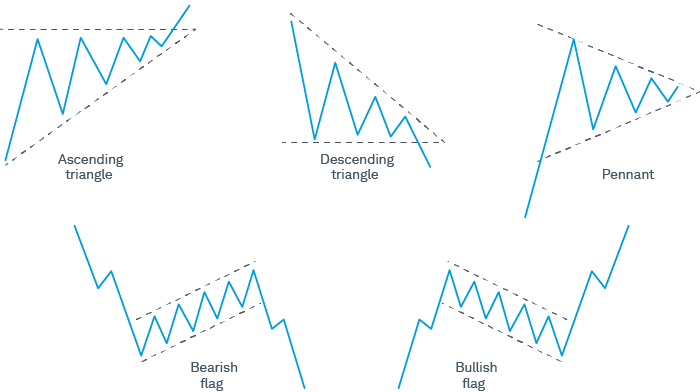

Swing Trading Strategies :

Markets receive their booms and so they also receive their busts. Prices may change rapidly in a single trading interval, and they may change little in many trading intervals, showcasing market’s continuous volatility.

Based on your investment horizon you may be interested in more long-term phenomenon such as long term trends and cycles including bull and bear markets. But within the larger currents exist a multitude of minor price fluctuations: It in the form of a series of blips, where it can swell and give ‘swing’ in the form of rallies and declines partially. In other words, one may find sub-trends in a given trend.

Some traders try to earn their profits on such fluctuations of the price level. That is the reason the term ‘swing trading’ is used to describe this specific kind of market speculation. You may have been enticed by the idea of doing so in this style yourself at one time. If you are not very much acquainted with it, you might want to read on to find out how it is.

Swing trading is among the numerous market speculation strategies and entails opportunity, but with given risks. Like most trades in the market, those who profited in the secondary market were just enriched while a different story is ‘the road ahead.

Swing Trading vs Day Trading :

Swing trader hold the stock , trades or commodities for days , week or month to capture the short term to medium term profit unlike Day Trader capitalize, profit in short term rather than holding a stock in week or month.

Key Features Of Swing Trading:

Position or Time Management : Swing Trader can hold the position for a days, week or month.

Trend-base: Swing trading realize on trend it will change according to market condition.

Key Feature of Day Trading:

Market gaps:

All trades are closed by market end not worry about overnight news or market gaps for trader.

Leverage system:

In day trading day trader borrow funds for increasing their Potential profit or their

position in market.

Overnight position:

In day trading is the end of overnight position because trades closed in all trading session.

How Both are Flexible?

Both trading swing trading and day trading is flexible for those trader who cannot monitor the market for full time or those traders who want to trade for a short term and make a profit.

Risk in Swing Trading:

Price Changing:

In Swing trading there is a market Risk . Holding the overnight postions exposes the swing trader to market gap that can lead to the significant price change.

Cost:

Swing trader frequently trade in a market then frequent trade can lead the commission or higher fees.

Patience:

In Swing trading for trader must require patience because in trading may require holding positions longer than expected.